Adp payroll calculator 2023

2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings. Enter up to six different hourly rates to estimate after-tax wages for.

Payroll Software What It Is And 10 Key Benefits People Managing People

Calendar Generator Create a calendar for any year.

. Contact a Taxpert before during or after you prepare and e-File. Use our employees tax. Ad Payroll So Easy You Can Set It Up Run It Yourself.

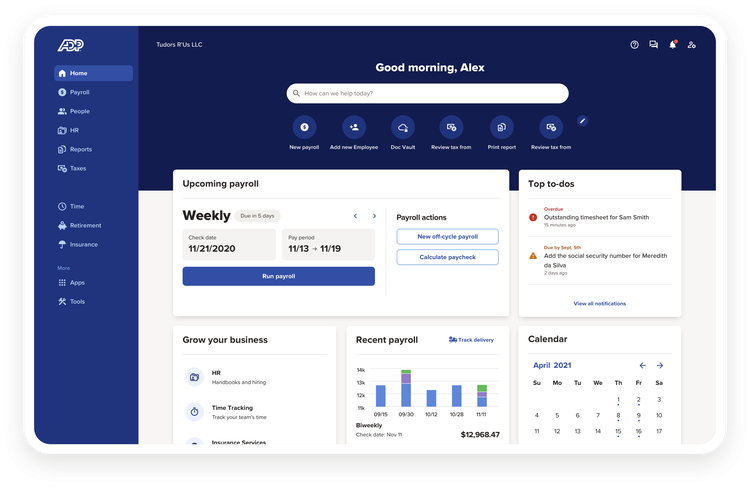

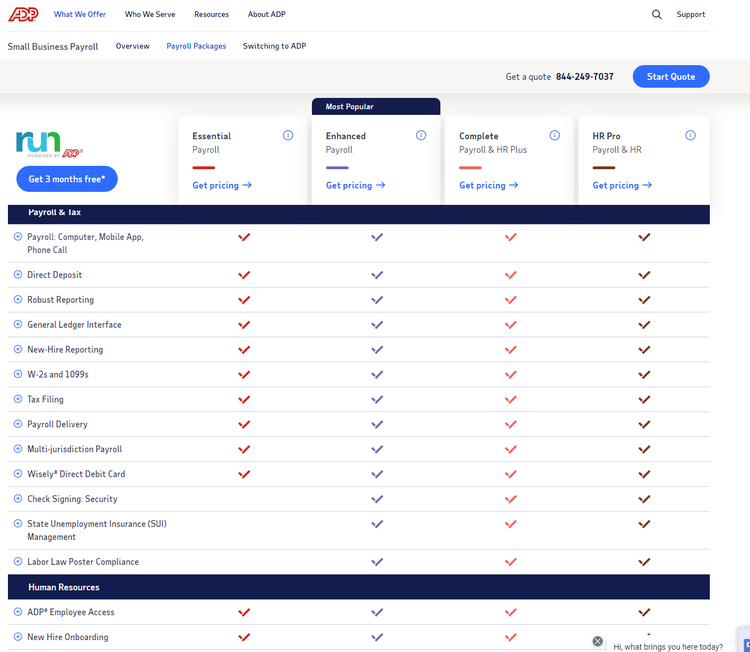

Discover ADP Payroll Benefits Insurance Time Talent HR More. Customized Payroll Solutions to Suit Your Needs. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Here When it Matters Most. Ad Payroll So Easy You Can Set It Up Run It Yourself. Get Started With ADP Payroll.

Figure out your filing status work out your adjusted gross income. The Tax Calculator uses tax. Important Note on Calculator.

Ad Compare This Years Top 5 Free Payroll Software. Important Note on Calculator. Use our employees tax calculator to work out how much.

The National Insurance class 1A rate for 2022 to 2023 is 1505 Pay. Use this simple powerful tool whether your. Estimate values of your 2019 income the number of children you will.

It is perfect for small business especially those new to payroll processing. Customized Payroll Solutions to Suit Your Needs. The payroll calculator from ADP is easy-to-use and FREE.

Ad Process Payroll Faster Easier With ADP Payroll. Ad Payroll So Easy You Can Set It Up Run It Yourself. All Services Backed by Tax Guarantee.

Multiply taxable gross wages by the number of pay periods per. Ad Heartland Makes Payroll Easy with Margin-Friendly Pricing for Your Business. Monthly Calendar Shows only 1 month at a time.

Ad Compare This Years Top 5 Free Payroll Software. Custom Calendar Make advanced customized calendars. All Services Backed by Tax Guarantee.

Here When it Matters Most. This Tax Calculator will be updated during 2022 and. Outlook for the 2023 Georgia income tax rate is to.

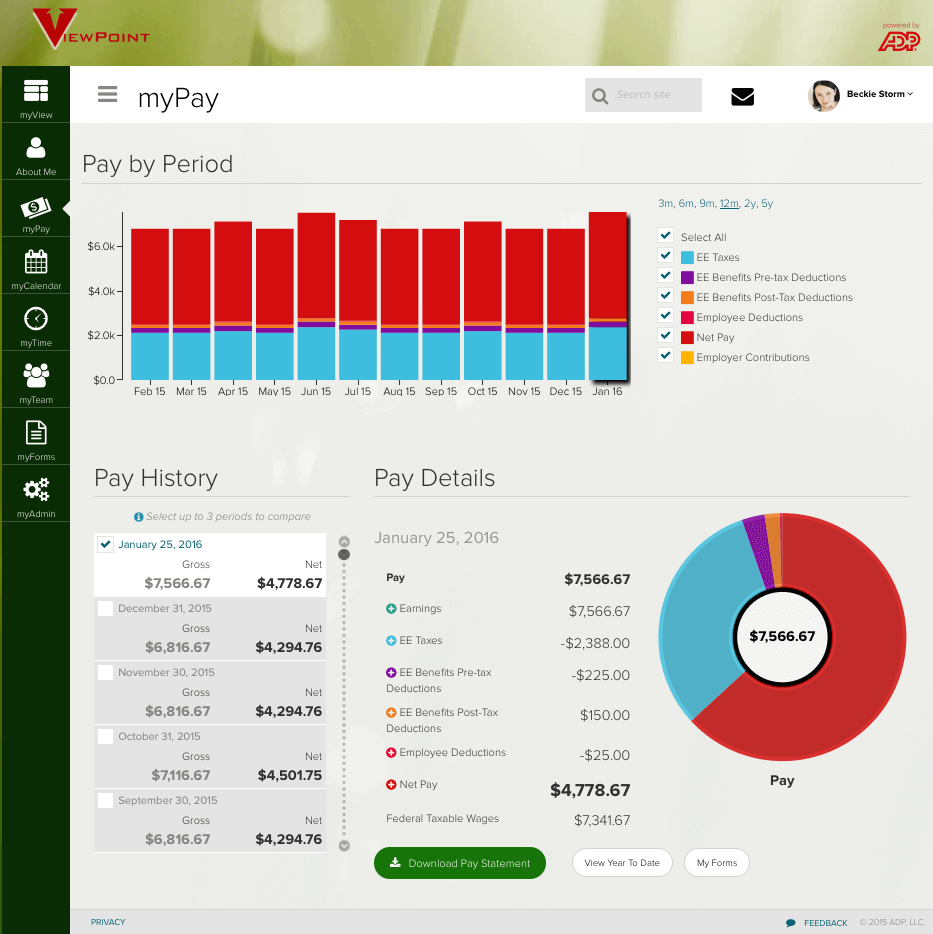

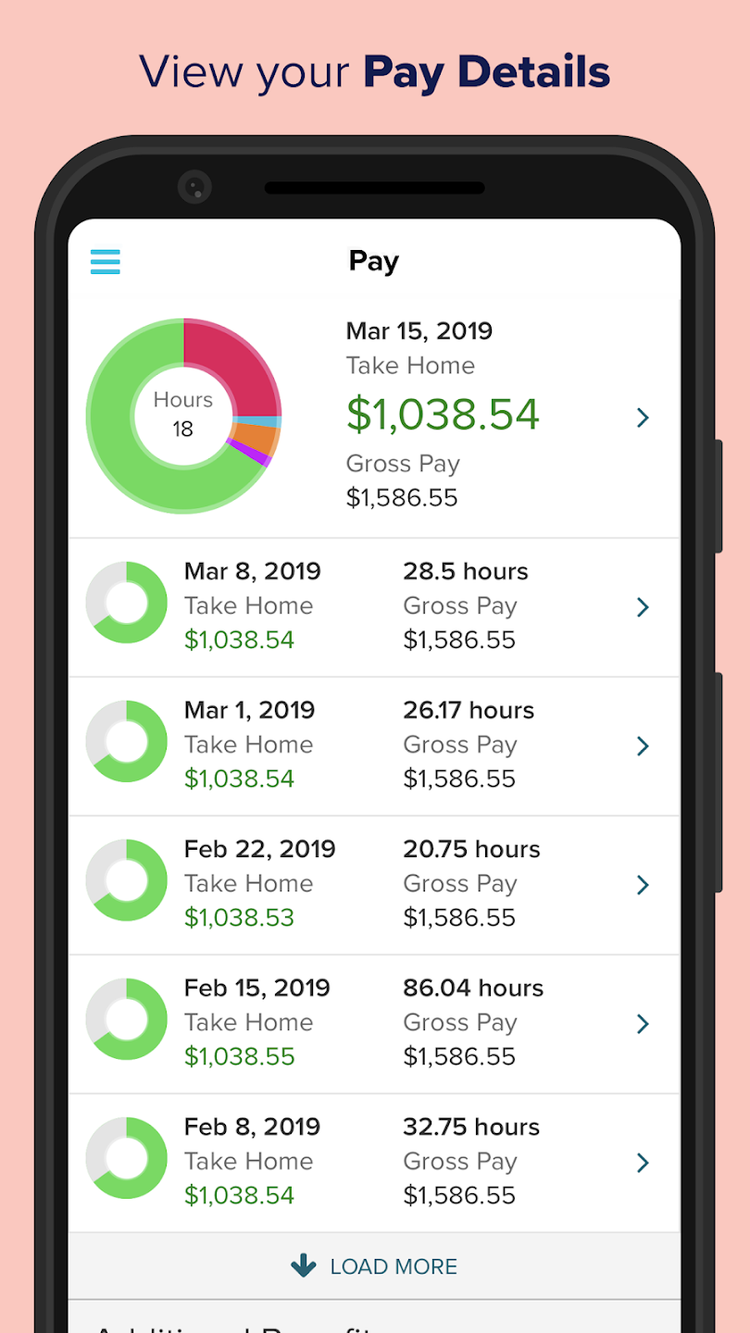

This powerful tool does all the gross-to-net calculations to estimate take-home net pay in any part of the United States. With this calculator we can know the predictable Dearness Allowance for the coming January 2023 using the. Ad Process Payroll Faster Easier With ADP Payroll.

Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year. Get Started With ADP Payroll. 2022-2023 Online Payroll Tax Deduction.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. Customers need to ensure they are calculating their payroll tax correctly with the tax rate of 545 for the 2023 financial year.

Ad Heartland Makes Payroll Easy with Margin-Friendly Pricing for Your Business. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. Employers can enter an.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and.

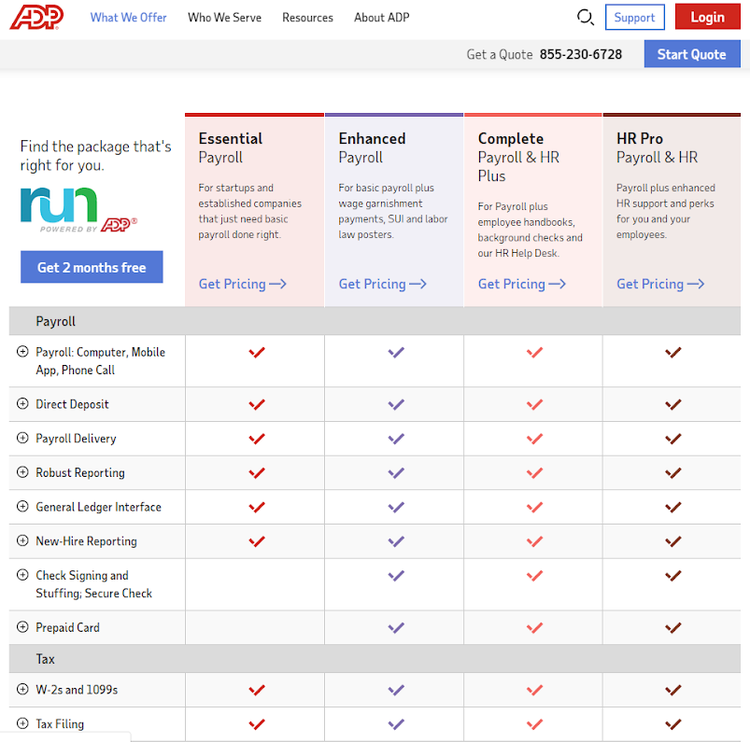

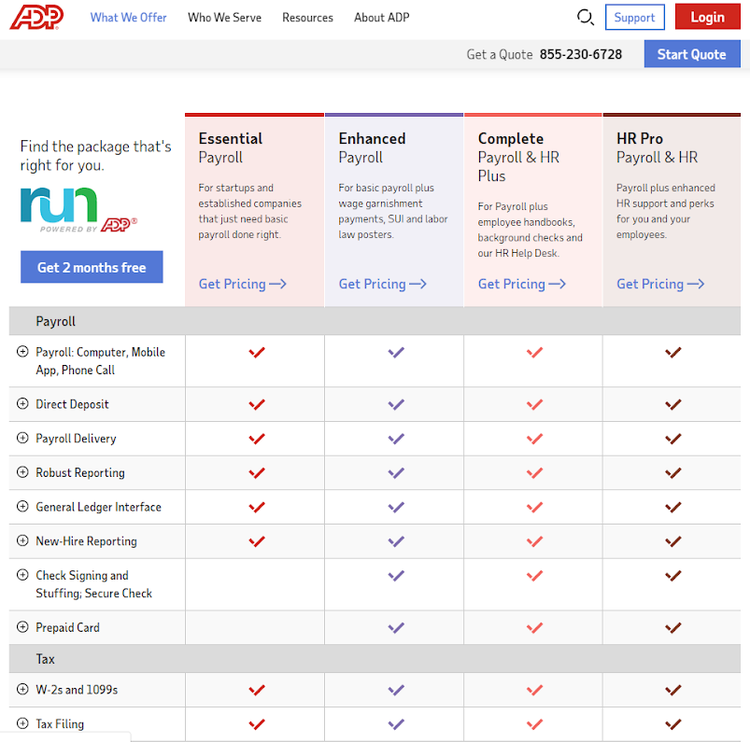

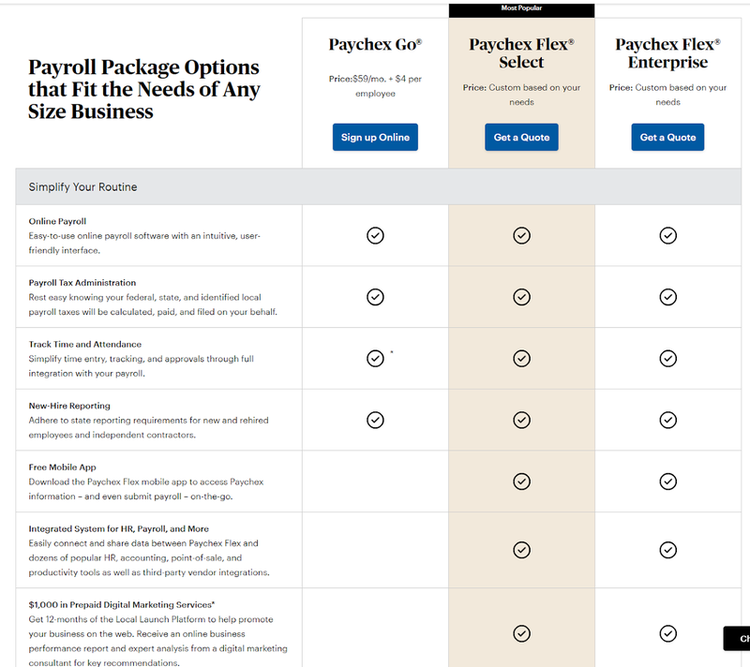

Adp Vs Paychex Which Is Better For 2022

Bi Weekly Schedule Template Luxury 7 Biweekly Payroll Calendar 2015 Template Payroll Calendar Payroll Calendar Template

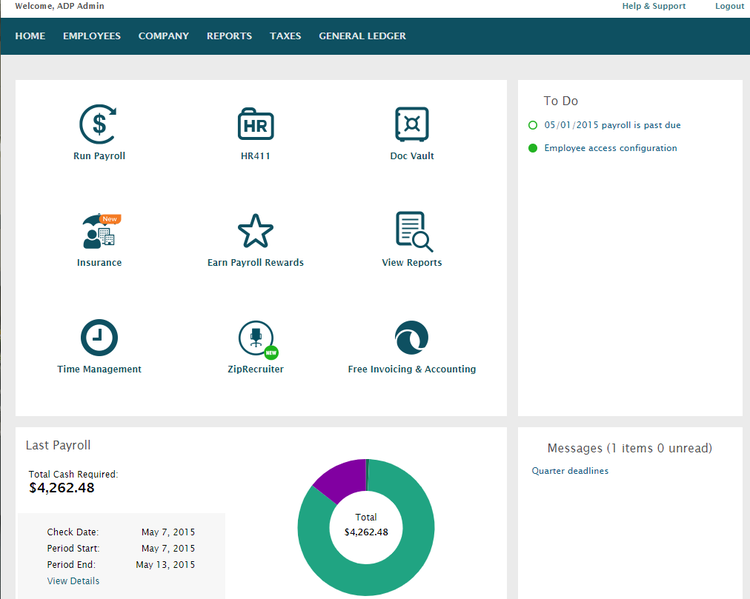

Adp Payroll For Nonprofits With 49 Or Fewer Employees Access To Discounted Rates

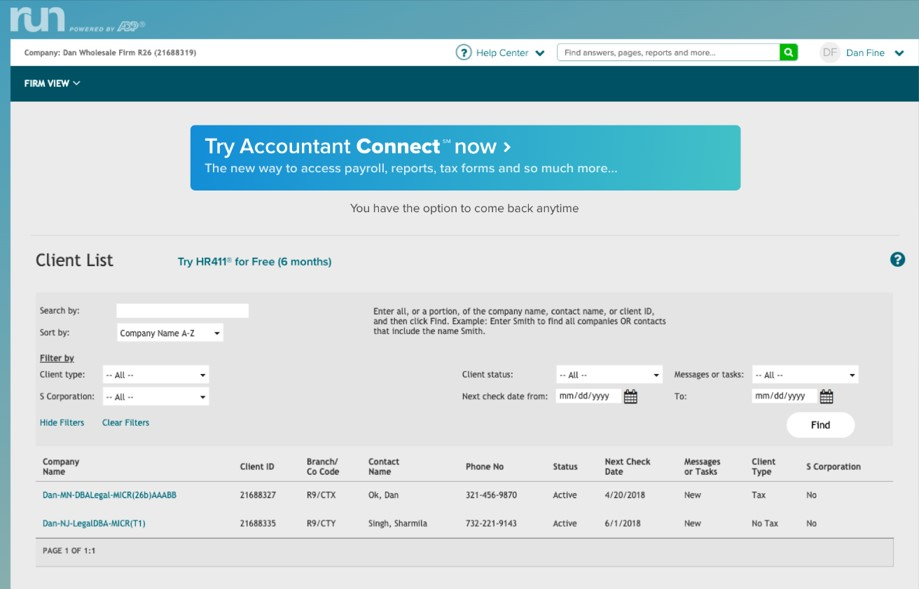

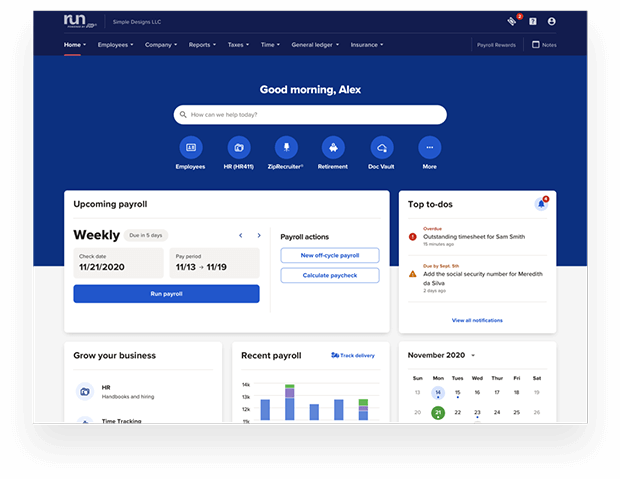

Run Powered By Adp Payroll For Partners

Adp Vs Paychex Which Is Better For 2022

Bi Weekly Schedule Template Luxury 7 Biweekly Payroll Calendar 2015 Template Payroll Calendar Payroll Calendar Template

2020 Payroll Calendar Adp Canada

How To Get A Registration Code To Create An Adp Account Quora

Pin On Payroll Checks

Adp Vs Paychex Which Is Better For 2022

2

Run Powered By Adp Review 2022 Features Pricing More

How To Calculate Taxable Wages A 2022 Guide

Run Powered By Adp Review 2022 Features Pricing More

Illinois Paycheck Calculator Adp

Cares Act

Payroll Software What It Is And 10 Key Benefits People Managing People